The recent struggles for technology companies are sometimes compared to the dot com bust, when scores of once-hot businesses watched their stock prices land with a thud.

While there were plenty of casualties during that era, Amazon survived and thrived.

Here are four reasons why that happened.

The Stock Price Is Not The Company

Stock price swings capture real-time investor sentiment.

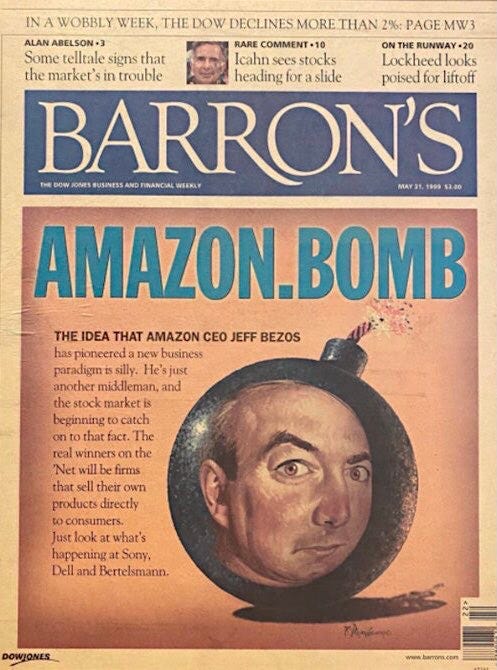

When the NASDAQ peaked in March of 2000, sentiment surrounding Amazon was brutal.

The stock had been falling since December of 1999.

It would continue to fall until September of 2001, ultimately losing nearly 95% of its value.

Jeff Bezos’ shareholder letter for the year 2000 began with a single word: “ouch.”

“It’s been a brutal year for many in the capital markets and certainly for Amazon shareholders,” Bezos wrote. “As of this writing, our shares are down more than 80% from when I wrote you last year. Nevertheless, by almost any measure, Amazon is in a stronger position now than at any time in its past.”

Indeed, a closer look at Amazon’s financials show that revenue grew more than 140 percent from 1999 to 2002, while the company’s profit margins went positive after being negative.

“As the stock price was going the wrong way, everything inside the company was going the right way,” Bezos later recalled, during a 2018 interview with David Rubenstein.

“I was watching all of our internal business metrics: number of customers, profit per unit, you know, everything you can imagine, defects, etc. Every single thing about the business was getting better and fast,” Bezos said.

With that knowledge, Bezos continued to feel confident that Amazon’s sales volumes would eventually grow enough to cover the company’s fixed costs.

Cash Is King

While Bezos was confident Amazon could ride out the storm, it required the company to be well capitalized.

Luckily, Amazon had taken advantage of such opportunities before the downturn really took hold.

Brad Stone’s book, The Everything Store, highlights how Amazon raised $672 million in early 2000, thanks to a timely sale of convertible bonds to European investors.

The company received help on the deal from Morgan Stanley banker Ruth Porat, who would later become Google’s Chief Financial Officer.

While the changing environment meant less favorable terms on the bond deal for Amazon, just having the money ended up being a life saver.

“We didn’t need to go back to the capital markets,” Bezos told David Rubenstein in 2018.

“We already had the money we needed. So, we just needed to continue to progress.”

Know When To Cut Your Losses

It’s one thing to ensure you have enough money, it’s another to decide where not to invest.

Amazon’s shareholder letter in 2000 addresses Bezos’ decision to cut his losses on some bad investments during the boom times.

As part of its strategy to branch out beyond selling books, music and DVDs, Amazon had invested in more than a dozen public and private e-commerce businesses.

‘We made these investments because we knew we wouldn’t ourselves be entering these particular categories any time soon, and we believed passionately in the ‘‘land rush’’ metaphor for the Internet,” Bezos explained in that letter.

Unlike Amazon, however, many of those companies no longer had enough money to prepare for leaner times when the capital markets dried up.

Some of the flameouts Amazon invested in included living.com and Pets.com.

“We were significant shareholders in both and lost a significant amount of money on both,” Bezos acknowledged in the shareholder letter.

But Bezos went on to explain in the letter why Amazon decided not to put more money into those businesses, in an attempt to keep them alive.

“As painful as that was, the alternative—investing more of our own capital in these companies to keep them afloat—would have been an even bigger mistake.”

Always Keep An Eye On The Future

Bezos’ ability to keep an eye on the future is one of the biggest factors that has separated Amazon from most companies.

Encouraging employees to think bigger allowed Amazon to make great strides, while some businesses were still recovering from the dot com crash.

The NASDAQ ended up bottoming out in 2002. Over the next five years, Amazon would roll out game changing initiatives, such as Amazon Prime (2005), Amazon Web Services (2006), and the Kindle (2007).

“We don’t have enough time for me to list all of our failed experiments,” Bezos told David Rubenstein. “But the big winners pay for thousands of failed experiments. So, you try something like Prime and it was very expensive at the beginning, it cost us a lot of money… but we could see that all kinds of customers were coming and they appreciated that service. So that’s what led to Prime.”