As always, picks of the week at the bottom of the newsletter.

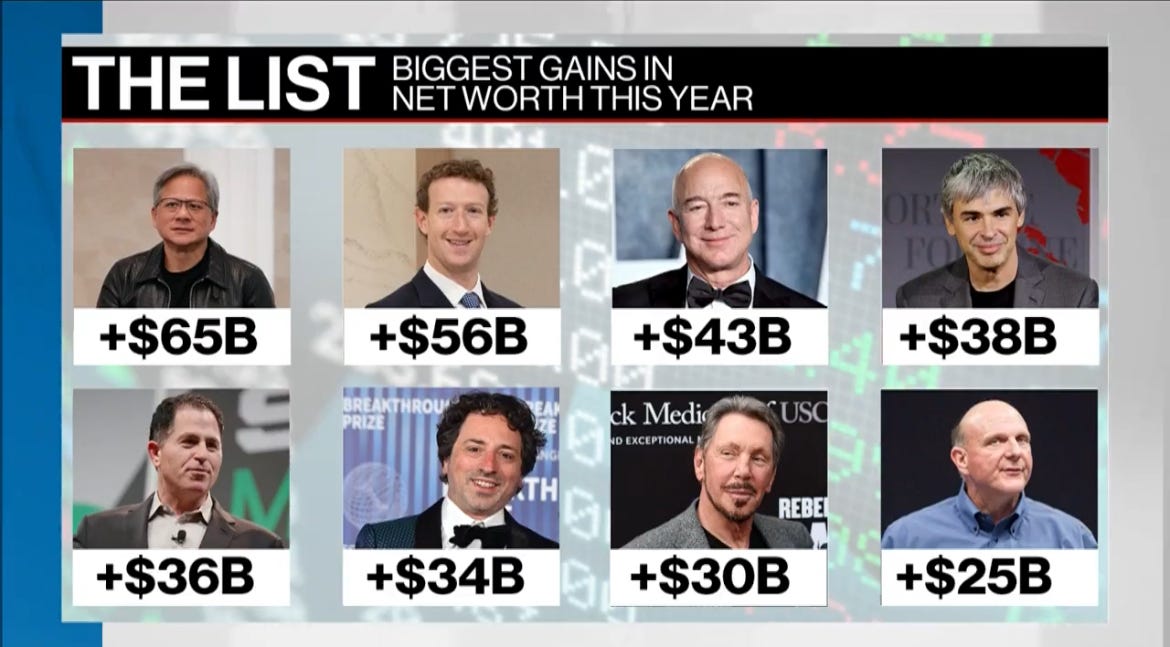

AI frenzy fuels billionaire fortunes

The AI frenzy has helped Jensen Huang’s net worth rise more than any other billionaire this year. Nvidia’s co-founder and CEO has seen is fortune increase in value by $65 billion. Here are the other billionaires who have seen their net worth increase by at least $25 billion in 2024:

Jensen Huang: +$65 billion

Mark Zuckerberg: +$56 billion

Jeff Bezos: +$43 billion

Larry Page: +$38 billion

Michael Dell: +$36 billion

Sergey Brin: +$34 billion

Larry Ellison: +$30 billion

Steve Ballmer: +$25 billion

AI’s distorted impact on the stock market

It has certainly been a year of have’s have not’s. According to Bloomberg Intelligence, the market caps of U.S. artificial intelligence companies have surged 6.5 times more than all others in 2024.

And looking globally, AI market caps have leapt 13.6% on average, versus 2.7% for everyone else.

The net result? Market distortions far surpassing the tech sector’s impact during the dot-com bubble in the late 1990’s. I guess the question for investors is…does that matter?

BI’s Chief Equity Strategist Gina Martin Adams says unlike the speculative bubble in the initial days of the internet, AI’s earnings trends support much of the case for the current gains.

I suppose if that changes… buckle up!

The bottom line on chip stocks

Longtime semiconductor analyst Stacy Rasgon of Bernstein still sees Nvidia as the best way to play AI. Here are his views on 5 sector names, along with his price targets.

AMD ($140 target): “A burgeoning AI narrative may not be keeping up with expectations, and is offset somewhat by core business weakness.

Broadcom ($1,950 target): AVGO benefits from better semi visibility, software economics, cash deployment, superb margins & FCF, and a supportive AI story.”

Intel: ($35 target): “Intel's problems have broken through to the forefront.”

Nvidia: ($130 target): “The data center opportunity is enormous, and still early, with material upside still possible.”

Qualcomm: ($220 target): “Weak smartphones appear to have bottomed with demand stabilizing, upside opportunities and adjacencies exist, and the shares remain inexpensive.”

Cash flow machines

We wanted to take a look at some of the cash flow “machines” in the stock market. Free cash flow is a great measure of how much money a company has left over after dealing with its expenses. And there’s an elite group of cash flow players who are in a league of their own.

We took at look at companies in the broader markets who have market caps north of $10 billion who are also on pace for some massive cash flow this year. We limited our search to companies who are expected to generate at least $15 billion U.S. in free cash flow this year, based on Wall Street estimates.

Here are the names that made our list:

Microsoft

Apple

Nvidia

Alphabet

Amazon

AT&T

Meta

Berkshire Hathaway

Broadcom

Visa

P&G

Exxon

Johnson & Johnson

Home Depot

AbbVie

Chevron

PDD Holdings

Verizon

Where does Wall Street see the S&P 500 ending the year?

Obviously the AI stock gains have led to fair questions about valuations and whether we could be in for some turbulence ahead. But on Wall Street, at least half of the 20 top strategists Bloomberg has polled see more gains ahead. That includes some researchers who have been burned by previously bearish calls.

The most bullish call comes from Evercore ISI, which has a year end target of 6,000. That firm had fairly recently been warning of an imminent drop in equities, so its upbeat outlook is quite a reversal. Goldman Sachs and UBS, meanwhile, have raised their market outlooks three times since late last year.

As for the more bearish views out there, JP Morgan is the most cautious shop. One of its concerns is the possibility that interest rates will remain higher for longer and that investors are discounting that potential reality.

Here are the most bullish year-end S&P 500 forecasts:

Evercore ISI: 6,000

22V Research: 5,650

Goldman Sachs: 5,600

Citigroup: 5,600

UBS: 5,600

BMO: 5,600

And here are the most bearish year-end S&P 500 forecasts:

JP Morgan: 4,200

Scotiabank: 4,600

Stifel Nicolaus: 4,750

Investors should avoid the election noise

Well, that was quite the Presidential debate!

There will be plenty of talk about the election in the months ahead.

Many will wonder what it all means for stocks.

But I spoke with equity strategist Alec Young of MAPsignals this week.

And his main message to investors is to avoid the election noise because ultimately, history suggests equities could end the year strong.

That doesn’t mean there won’t be turbulence.

Young looked at S&P 500 performance during election years, going back to 1928. There are some pretty consistent themes. Stocks generally rally in the summer months, before posting declines in September and October. After that, November and December tend to be solid months. Here’s the breakdown…

Average S&P 500 monthly returns during election years:

July: +2.2%

August: +3.1%

September: -0.5%

October: -0.3%

November: +1.2%

December: +1.5%

Source: S&P, MAPsignals

A stock market play on Canada’s tight housing market

One of the big long-term trends in Canada is the growing demand for homes. We often look at that story through the lens of housing itself. But in the stock market, there are a number of real estate plays tied to the residential market. Minto Apartment REIT is one of them. The business operates more than two dozen notable rental properties across Canada’s big cities. Its roots tie back to one of the country’s biggest real estate players – Minto group. Minto REIT went public roughly six years ago. I spoke with the President and CEO Jonathan Li this week, who spoke about the company’s notable growth in Funds From Operations (FFO) per unit. Minto is a well liked REIT, with a majority of analysts recommending it to investors. While REITs have struggled in the current interest rate environment, Li says he’s confident the plan to focus on urban markets will serve the company well. It has also shown a consistent willingness to shed less core assets to improve its balance sheet.

Minto is one of the investor recommendations in our picks of the week section at the bottom of the newsletter.

Would you invest in an Airbnb for drivers?

Summer trips invite the question – hotel vs Airbnb. For drivers, increasingly there’s the question of car rentals vs car sharing services like Turo. The company connects car owners with short term renters. The San Francisco-based business has attracted some high profile investors. And Bloomberg has reported Turo could go public in the not too distant future.

I spoke to the CEO Andre Haddad this week. He said that given a wide range of car offerings, consumers like using the platform to test out new vehicles, particularly EV’s, which are quite commonly available through Turo.

Interestingly, Turo has also enabled entrepreneurial thinkers to become mini-car rental operators by offering their own fleets of vehicles through Turo.

Haddad noted the company has grown by 400% in the past three years. But he says they have also been profitable over that time.

As for an IPO, “we’re ready,” Haddad told me — suggesting that when the market conditions allow, we’ll see the company make its Wall Street debut.

Stocks with big commitments to dividends

We wanted to focus on some big dividend payout players. So we looked at data to determine a group of stocks that pay out more than half of their earnings as dividends. Assuming they are sustainable, high payout ratios are a good indicator for how shareholder friendly big, profitable companies can be.

So we started by looking at the S&P 500, the Nasdaq 100 and the TSX. Within those indexes, we singled out companies that had market caps of at least $25 billion to ensure a certain size of business. And we focused on stocks with payout ratios of more than 50%.

In addition, we added a couple more considerations. The companies had to have increased their profits by at least 10% in the past year (to indicate if the payout ratios are being supported by earnings growth). And finally, we wanted to know if these companies were expected to grow their dividends in the next 3 years, based on Bloomberg forecasting tools. Finally, we wanted to highlight just the companies that are recommended by at least 50% of the stock analysts who cover them. so we only used names that met all that criteria.

Against that backdrop, here are the stocks that made our list:

Colgate-Palmolive

Xylem

Eli Lilly

Becton Dickinson

BlackRock

American Tower

Restaurant Brands

Walmart

AbbVie

Corning

Pembina Pipeline

Welltower

Xcel Energy

Targa Resources

Southern Co.

Tractor Supply

Duke Energy

BMO

Prologis

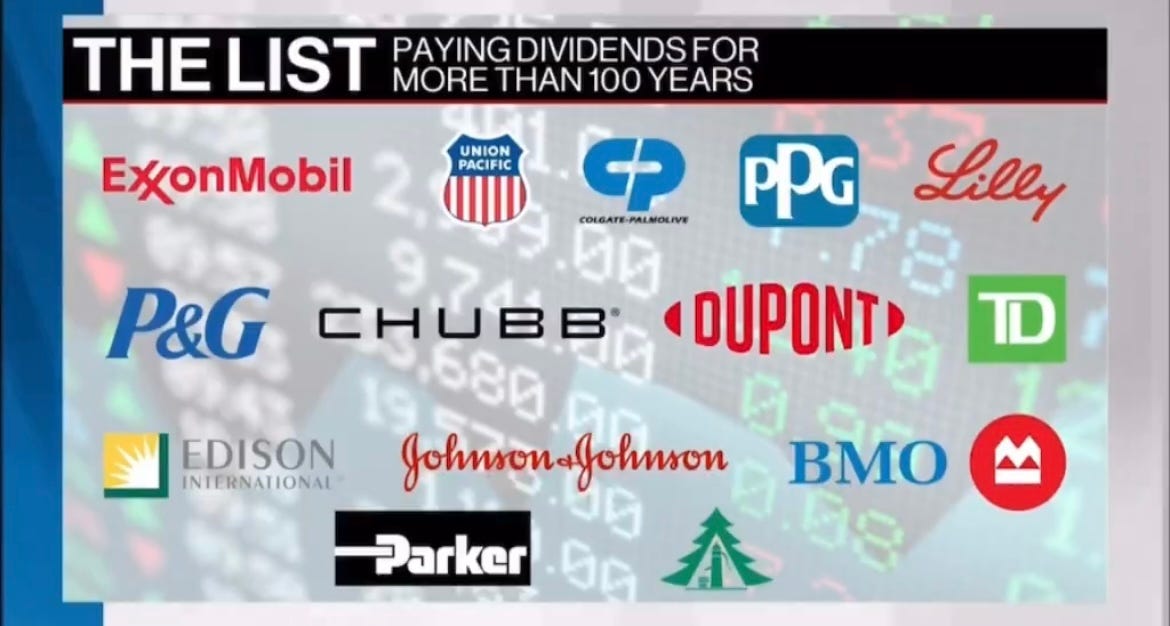

Stocks that have paid dividends for 100 years

Dividends, of course, are one of the helpful ways to boost returns over the long term. Getting paid to wait through payouts is popular enough with investors that many companies try to keep their dividend strategies in place. And there is a more select group of companies that have been paying dividends longer than any of us have been alive. These are sometimes called dividend zombies. These are companies that have been paying dividends for more than a century. Now, generally these are not high growth businesses. but when you’ve been paying a dividend that long, it’s part of the corporate culture and so there’s pressure to keep up the payouts.

Let’s start by taking a look at a list of some of these long time dividend payers who are currently recommended by at least 50 percent of the analysts who cover them:

Exxon Mobil

Union Pacific

Colgate-Palmolive

PPG Industries

Eli Lilly

P&G

Chubb

Parker-Hannifin

Dupont

Edison International

York Water

J&J

BMO

TD

Meanwhile, let’s broaden out the list to include some of the other members of the dividend paying century club:

Stanley Black & Decker

IBM

General Mills

American Electric Power

Cincinnati Financial

Genuine Parts

Con Edison

National Fuel Gas

Chubb

Scotiabank

CIBC

BCE

Imperial Oil

3M

UGI

Johnson Controls

Lancaster Colony

Hormel

Nordson

Picks of the week:

David Nelson, Belpointe Asset Management: IBM, Walmart

Chad Morganlander, Washington Crossing Advisors: Walmart, Microsoft, Colgate-Palmolive

Gavin Graham, The Income Investor: AltaGas, Capital Power, Pembina, Enbridge, Boralex, Telus, Boardwalk REIT, InterRent, Primaris, Minto REIT, Suncor, Canadian Natural Resources, Agnico Eagle, Pan American Silver, Franco Nevada

JoAnne Feeney, Advisors Capital Management: Broadcom, Microsoft, Nvidia, AMD, TSMC, Lennar, Williams-Sonoma, Palo Alto Networks, Rtx Corp, AbbVie, Kinder Morgan

Ryan Bushell, Newhaven Asset Management: Pembina

John Zechner, J. Zechner Associates: MDA, Capital Power, Torex Gold

Before you go…

…just a heads up we won’t have a newsletter next week. Back again soon!