Stocks lose a step

Stocks lost some momentum as the week wrapped up. While in the TSX in Canada gained ground for the week overall, the S&P 500 ended the week down more than 2%. It’s still up since Election Day.

Buffett’s pizza pick

New regulatory filings highlighted what some of the most successful investors have been doing with their portfolios lately.

Warren Buffett’s Berkshire Hathaway has added Domino’s Pizza to its portfolio, along with Pool Corp. Both stocks have been impacted, arguably, by more cautious consumer spending. The moves are notable, considering most of the headlines on Berkshire recently have been about its stock selling, lowering its stakes in both Apple and Bank of America.

As for other high profile investors, Bill Ackman has been loading up on shares of Brookfield and Nike, while Michael Burry has added some downside protection to his China portfolio. Burry still has plenty of exposure, through holdings such as Alibaba, but filings show he added some bearish options more recently.

Note: all charts above and below are provided by my friend MarketLab. Be sure to check out his weekly review of the markets at www.marketlabnewsletter.com

Did Netflix win the fight?

I posted a video about Netflix, given everyone is talking about the Tyson-Paul fight. It includes the Wall Street view on the stock and some projections on the number of new subscribers Netflix could add this quarter.

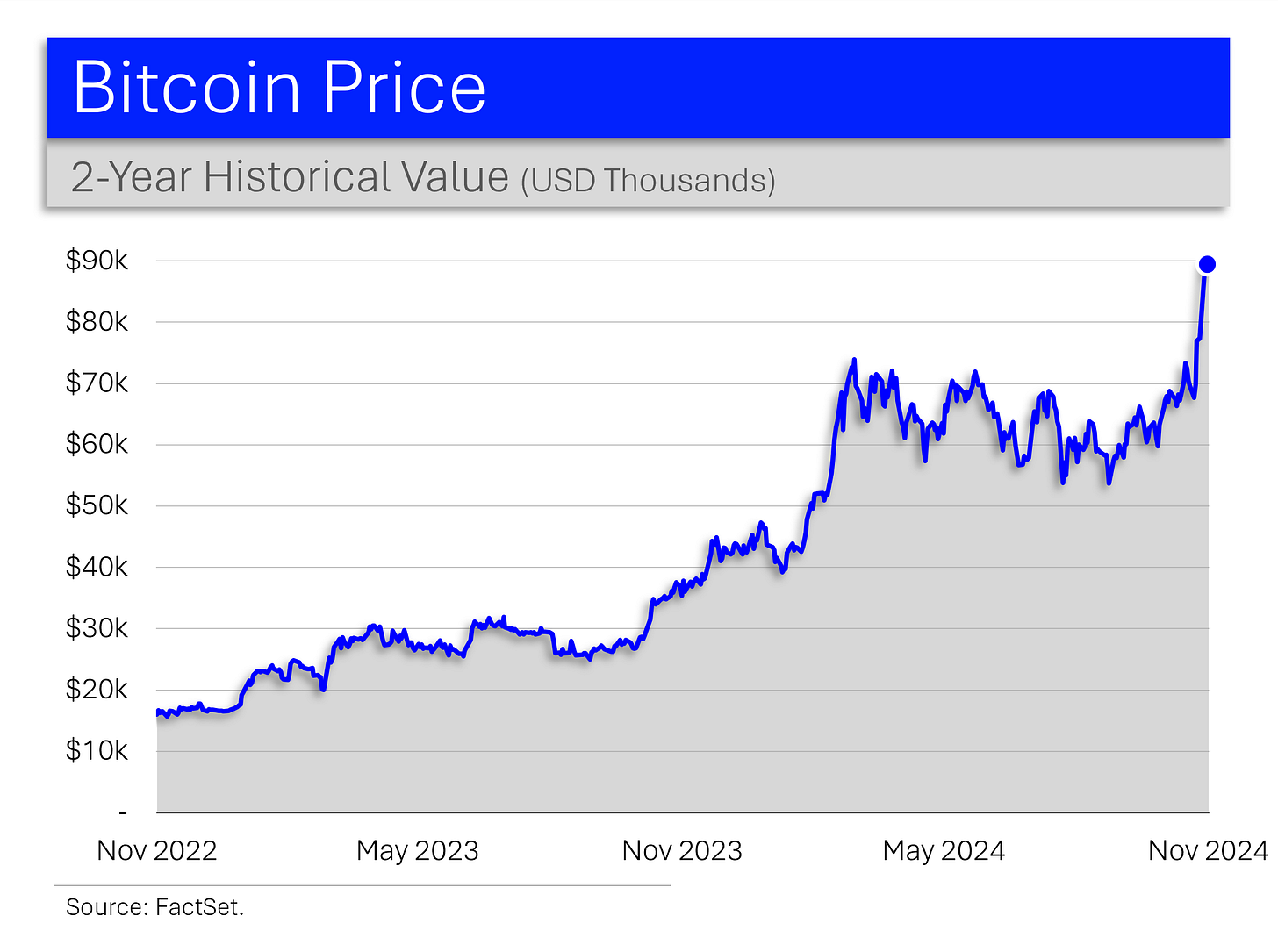

Can crypto stocks outpace Bitcoin?

I received a question on this subject from a TikTok viewer.

Stocks tied to crypto such as MicroStrategy, Coinbase and Marathon Holdings have enjoyed big advances during Bitcoin’s big climb. There’s an argument they are as attractive — if not more so — than spot Bitcoin ETFs, when it comes to being a liquid option for traditional investors. And crypto stock bulls have suggested they also provide more exposure to the broader crypto ecosystem, not just Bitcoin.

In past big run-up’s, these kinds of stocks have tended to outperform Bitcoin itself, although it should be mentioned that both MicroStrategy and Coinbase are now trading above the average 12 month target price assigned by analysts on Wall Street (Marathon is quite close to its target price as well).

The case for Citigroup

I spoke with investor Mike Clare of Brompton Funds who specializes in financial services. His top pick right now is Citigroup. His view aligns with a similarly bullish call on Bank of America that you’ll find in the analyst picks section at the bottom of the newsletter.

At the same time, it’s probably worthwhile to be mindful of how far financials have moved already. One viewer, Erik, asked me on TikTok about Goldman Sachs, a stock that is still well liked on Wall Street, but is now trading well above the average 12 month target price among the analysts who cover it.

Anyway, here’s the view on Citigroup…

S&P 500 vs the world

I got a question on Instagram from viewer Julian, who had inquired about the performance of the S&P 500 against the MSCI World Index, which has also moved higher this year (although not quite as much as the S&P).

Keep in mind that since the U.S. represents a big portion of the world’s investing assets, it has a big representation within the MSIC World Index, now representing 74% of its market cap according to Bloomberg — that is said to be a record high.

How an index like that will performance vs the S&P 500 in the new year could be influenced by the both the broader mood of the markets and the Trump Presidency.

One trend that is developing is a push by investors into U.S. assets at the expense of markets such as Europe, on concerns about the economic impact from Trump tariffs.

It’s been hard to lose money this year

Bloomberg’s ETF team had some interesting data, which found that more than 95% of ETFs in the U.S. have enjoyed positive returns in the past year. The gains have inspired buyers to flock to high beta funds, with a recent surge after the Presidential Election.

I’ll take dividends with my ETF

You ask great questions…which sometimes lead to other great questions! I had received a thoughtful inquiry about ETF’s to hold for the long haul. As you know, I don’t provide financial advice, so I cited Warren Buffett’s suggestion that holding an ETF tied to the S&P 500 over the long term makes solid financial sense.

That invited another question about dividend ETFs. There are so many out there — in the U.S., Canada and beyond — so I thought I would just flag the largest in the U.S. by assets:

Vanguard Dividend Appreciation ETF (VIG) - $88 billion in assets

Schwab US Dividend Equity ETF (SCHD) - $66 billion in assets

Vanguard High Dividend Yield Index ETF (VYM) - $60 billion in assets

iShares Core Dividend Growth ETF (DGRO) - $31 billion in assets

SPDR S&P Dividend ETF (SDY) - $21 bilion in assets

Note: all charts above and below are provided by my friend MarketLab. Be sure to check out his weekly review of the markets at www.marketlabnewsletter.com

It’s not timing the market…it’s time in the market.

My latest YouTube video was a family affair! My wife Caroline and my daughters Cali and Quinn helped to unpack one of the biggest regrets about investing — not starting early enough. If you haven’t seen it yet, check it out!

Analyst picks of the week

AbbVie

AbbVie’s stock has struggled after disappointing schizophrenia drug trials, but the analyst team at Wolfe Research sees an opportunity. In its view, the core business is still strong and the pullback makes the valuation appealing. Wolfe’s target price on the stock is $205.

Bank of America

The analyst team at Citi likes BofA ahead of Donald Trump’s official return to the White House. The idea of a lighter regulatory environment should benefit the bank and they have a price target of $54.

Carrier Global

UBS upgraded the company’s stock to buy, with a $94 price target. UBS notes Carrier will end the year as a pure play HVAC company, after $8 billion worth of divestitures in the past year.

Campbell Soup

My New York friends will be quite familiar Rao’s. Campbell Soup acquired the sauce maker’s parent company Sovos Brands earlier this year and the analyst team at Piper Sandler thinks it will benefit Campbell’s shareholders. The stock has trended lower in recent months, which Piper sees as a buying opportunity. Trump tariffs could be a headwind for the company (Piper estimates steel, which is used to make its soup cans, accounts for 4% of Campbell’s costs), but overall the firm sees the business as one of the best positioned in the large cap food category. Its price target on the stock is $56.

Cboe

Deutsche Bank analysts upgraded Cboe shares, arguing that the volatility in the markets post-election will benefit the exchange operator for the next while. Deutsche Bank has a $222 price target on Cboe shares.

Nvidia

Ahead of Nvidia’s upcoming earnings, a whole host of analysts have been pushing up their price targets on the chipmaker’s stock. Wedbush now has a price target of $160, while Raymond James and Citi upped their targets to $170. HSBC is even more bullish, now seeing the shares heading to $200

Suncor

Analysts at Desjardins upgraded the energy giant’s stock after what they described as a third quarter “masterpiece,” in reference to Suncor’s latest financial results. Desjardins now has a $66 target on the TSX listed shares.